SOL Price Prediction: Technical Weakness Meets Fundamental Strength

#SOL

- SOL trades at $157.91, below the 20-day moving average of $185.17, indicating short-term bearish pressure

- Mixed fundamentals with $382M unrealized losses offset by $1B share buyback signaling long-term confidence

- Technical indicators suggest consolidation while institutional ETF inflows provide underlying support

SOL Price Prediction

SOL Technical Analysis

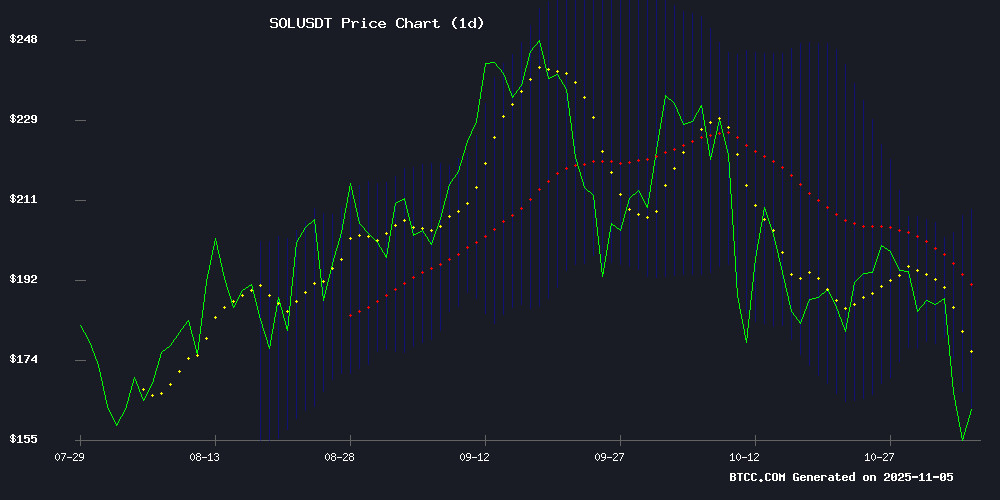

According to BTCC financial analyst James, SOL is currently trading at $157.91, significantly below its 20-day moving average of $185.17, indicating short-term bearish pressure. The MACD reading of -1.16 shows negative momentum, though the price remains within the Bollinger Band range between $161.32 and $209.01. James notes that while current technical indicators suggest consolidation, the position above the lower Bollinger Band provides some support.

Market Sentiment Analysis

BTCC financial analyst James points to mixed signals in SOL's fundamental landscape. Forward Industries reporting a $382 million unrealized loss on solana holdings creates near-term headwinds. However, James emphasizes that institutional demand remains strong through ETF inflows, and the company's $1 billion share buyback signals long-term confidence in their Solana treasury strategy. This creates a divergence between technical weakness and fundamental optimism.

Factors Influencing SOL's Price

Forward Industries Reports $382M Unrealized Loss on Solana Holdings

Forward Industries, Inc. (NASDAQ: FORD) faces a $382 million unrealized loss on its $1.2 billion solana (SOL) position, as the token's price decline erodes its investment. The company acquired 6.82 million SOL tokens at an average price of $232, now trading at $156.43—a 24.13% drop. Forward's market capitalization has plummeted to $900 million, down 73.6% from its peak.

Solana's ecosystem mirrors the strain, with DeFiLlama data showing a 5.44% daily drop in total value locked (TVL) to $9.92 billion. Despite $29.33 million in inflows and $797,785 in NFT trading volume, chain revenue stagnates at $114,934 over 24 hours. The correlation between corporate holdings and underlying asset volatility underscores crypto's high-risk, high-reward paradigm.

Solana Defies Crypto Outflows as Institutional Demand Surges via ETF Inflows

Amid a $360 million exodus from crypto investment products last week, Solana emerged as a stark outlier. The Bitwise SOL Staking ETF (BSOL) debuted with $417 million in inflows—the largest weekly inflow of any crypto ETP—while traditional heavyweights like Bitcoin ETFs faltered.

This institutional endorsement comes despite Federal Reserve warnings that December rate cuts remain uncertain. BSOL's success establishes a regulated gateway for U.S. investors to access Solana's staking yields, with an additional $65.2 million flowing in this week according to Farside data.

The divergence highlights growing institutional conviction in Solana's ecosystem. With spot ETF approval still pending, BSOL's explosive debut may foreshadow pent-up demand for regulated SOL exposure—a bullish signal for price trajectory.

Forward Industries Announces $1 Billion Share Buyback, Signals Confidence in Solana

Forward Industries has authorized a $1 billion share repurchase program, set to run through September 2027. The board-approved initiative underscores the company's bullish stance on its financial strategy and Solana's ecosystem.

Chairman Kyle Samani emphasized the MOVE reflects confidence in Forward's strategic pivot and Solana's underlying strength. The company has actively managed its SOL holdings since September, partnering with institutional heavyweights like Galaxy Digital and Multicoin Capital.

Simultaneously, Forward filed a resale prospectus with the SEC, enabling private placement investors from 2025 to liquidate positions. While procedural, this filing coincides with the aggressive buyback plan that positions Forward as a corporate advocate for Solana's blockchain infrastructure.

Forward Industries Authorizes $1B Share Buyback Amid Solana Treasury Strategy

Forward Industries, a Solana-focused treasury firm, has filed a Resale Prospectus Supplement with the SEC while greenlighting a $1 billion stock repurchase program. The move signals confidence in its blockchain-based strategy and commitment to shareholder value.

The filing registers shares from a September 2025 private placement for potential resale by existing investors. Notably, the company won't receive proceeds from any sales—the mechanism primarily provides liquidity for PIPE participants.

Board approval of the buyback program on November 3 represents a bold capital allocation decision. Such aggressive repurchases typically indicate management's belief their stock is undervalued, particularly noteworthy for a crypto-native firm during volatile market conditions.

Is SOL a good investment?

Based on current analysis, SOL presents a complex investment case. Technically, the cryptocurrency shows bearish signals trading below key moving averages with negative MACD momentum. However, fundamental factors provide counterbalance with strong institutional ETF inflows and corporate confidence demonstrated through Forward Industries' $1 billion buyback program.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $157.91 | Below 20-day MA |

| 20-day MA | $185.17 | Resistance Level |

| MACD | -1.1565 | Bearish |

| Bollinger Lower | $161.32 | Support Level |

James suggests investors consider dollar-cost averaging given the technical consolidation phase and wait for clearer bullish confirmation above the 20-day moving average.